Last year, I wrote this analysis of Pandora's Q1 2015 financial results along with some ideas of how to deal with the inevitable sunsetting of the reseller agreement you have with them. For today's #ThrowbackThursday, I'm revisiting that topic with an analysis of Pandora's Q4 2015 financial reports that were published last week.

Background

Pandora has made enormous strides in building their brand since entering the US market 2003 simply by controlling all of their marketing. You see, retail stores who sell Pandora jewelry are required to use pre-approved advertising without any alteration, and many times Pandora's own marketing department will manage the ad placements. If you'd like to send an email notice of an upcoming event, Pandora asks retailers for their email list and sends it on their behalf.

In a brilliant branding move, Pandora only allows retailers to add their store logo and contact information to the approved ads. This forces a unified brand building message across all local markets simply because the same imagery is seen everywhere, which then drives traffic to any of the local stores. Every ad displays the Pandora name in high prominence while downplaying the name of the local retail store. This is the exact type of branding technique that's needed to build an internationally recognized brand, yet they did it through the support of local retailers.

Since becoming a public company in 2010, Pandora is required to generate a profit for their shareholders, which means they must make decisions based on their financial benefit rather than the benefit of independent retail jewelers.

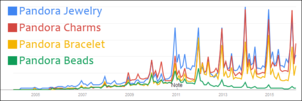

Pandora in Google Trends

Pandora introduced themselves as a bead line when they first entered the US market, but that phrasing has since been depreciated as they developed other lines of jewelry. By carefully controlling the brand message in all the advertising, Pandora was able to transform themselves from being known as "Pandora Beads" to "Pandora Charms" and also "Pandora Jewelry." Google Trends shows a good progression of the charms and jewelry keyword searches in this link: http://bit.ly/pandorasearch

Here's a snapshot of that latest trends chart:

(click to enlarge)

Looking closely, you'll see that the phrase "Pandora Charms" was more popular during the 2015 holiday season and the phrase "Pandora Jewelry" dropped in popularity. Trends in Google search are a clear indication of marketing success, word of mouth, and other Zero Moments of Truth that influence behavior. It certainly seems like the word "charms" was more influential in later 2015 than "jewelry."

Digging Into Pandora's Q4 2015 Financials

Pandora publishes their investor documents here. The following is my commentary on the "PANDORA Q4 2015" interim report you'll find on that page. However, I won't comment on their profits, for that you can refer over to Rob Bates' JCK article here. Instead, I'll focus on interpreting their potential plans and possible future treatment of retail jewelers.

Most of the report details their current financial statements and operations around the world. There are only a few pages which directly relate to retailers in North America. Starting on page 8 of their report, they announced their expectation to open 200-300 new concept stores worldwide every year from 2016-2018, 20% of which are expected to be in the Americas. That's 60 potential new Pandora-owned stores throughout North and South America, which translates to about 180 local markets. No doubt that means competition with independent retailers. Page 8 also includes details for opening concept stores and Shop-in-shop stores in other countries. However, what's lacking is any mention of new Gold level retailers or Shop-in-shops in the Americas.

An explanation of their 2015 profits is given on page 9 of their report. They explain that they opened 271 new stores in 2015, including 62 concept stores. Revenue from Pandora's owned and operated stores accounted for 33% of their 2015 revenue. They specifically state the benefit of higher revenue by selling direct at retail prices than the wholesale prices they previously earned when selling to their retail channel.

They further state that the success of their concept stores "was driven by a successful product portfolio with continuous relevant products, generally better in-store execution as well as increased awareness through regional marketing campaigns increasing store traffic in most stores." In other words, they provided a good merchandising mix which was promoted by the unified marketing strategy they employ.

Speaking of their merchandising mix, they will be heavily promoting earrings throughout 2016.

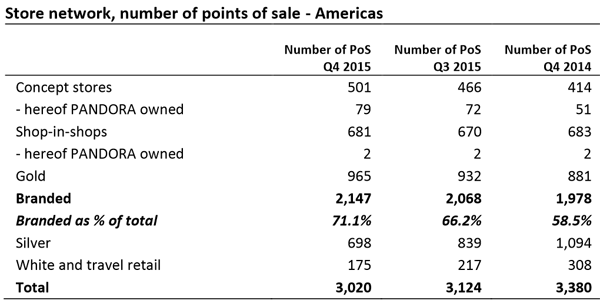

I pulled the next table from page 11 of their report:

Here we see that Pandora is steadily increasing the number of Concept stores but slowing the pace of the expansion of their Shop-in-shop and Gold branded stores. Furthermore, the number of unbranded stores at the Silver and While level is rapidly declining, and they plan to continue closing them down.

In 2016, Pandora and Signet will work together to upgrade about 200 Jared stores to Shop-in-shops.

None of this is good news for unbranded stores, and even the current Gold and Shop-in-shop stores will feel the competition as Pandora opens more Concept stores and expands the footprint inside the local Jared. Remember, their corporate profits will continue to increase as they replace the retailer channel with more Concepts stores. They like those retail profit margins.

Closing Thoughts

In simple terms, if you don't like the treatment Pandora is giving you as one of their retailers, well, that's just too bad. They care about their bottom line and not yours. Nor do they care about the uniqueness of your local market and what might appeal to your community. I've had several retail jewelers tell me that Pandora was the only product selling through the recession, and it saved their business. Even if this is true, retail store owners must make decisions based on their own future bottom line.

Pandora certainly seems to be moving towards ownership of all their retail outlets, and it seems like it won't be long before they cut off all independent retailers. It's been a while since I was a licensed stock broker giving buy/sell recommendations, but if I was a Pandora retailer, I would figure out how to cash out of Pandora arrangement and invest my money into Pandora stock instead. After all, as of this writing on February 17, 2016, their stock price has jumped about 2,040% since August 2011. Obviously their business model works, but you should consult with your own investment professional and ask them if they think Pandora's stock will keep rising.

Those of you riding the Pandora wave should put serious thought into how your business would change if that business was suddenly gone. Even if you think it won't happen because you have a Gold or Shop-in-shop branded location, the corporate direction indicates that it will, and you should be prepared.