Over the past 5 years, many retail jewelry store owners have asked my opinion about a jewelry designer before deciding to buy into a new line. I always find these questions interesting because they are asking my opinion as a data analyst, rather than a current trends watcher.

You see, you can easily track the popularity of a jewelry designer based on the number of people who search Google for their name or product name. Google allows you to explore search trends on your own at this address:

http://www.google.com/trends/explore

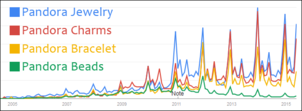

Back in the mid 2000s, Pandora was one of the first designer lines I started following through these trends. This was when Pandora charms were just gaining in popularity and many retailers were hesitant to buy into, what they referred to as, "an inexpensive silver bead line."

Through 2010, the retail jewelers who bought into the Pandora line were happy they did so. Pandora sales supported many jewelers through the worst part of the recession.

The "Pandora Beads" nomenclature was quickly left behind right after Pandora had their IPO in September 2010. During the holiday 2010 season, the hot new trend was "Pandora jewelry." You can see the rise and fall of search popularity by visiting this link: http://bit.ly/pandorasearch.

Here's a snapshot of the search popularity chart:

(click to enlarge)

The tall peaks you see in that Pandora Search Popularity chart represent when the general public was searching for the jewelry. Naturally the tallest spikes always occur in the months of December. Those tall spikes also represent when the retail stores are selling the most inventory.

On May 12, 2015, Pandora held a stockholder teleconference to announce their Q1 2015 financial results. You can see this report yourself here. Click on the "Q1 2015 Investor Presentation" to see the slides.

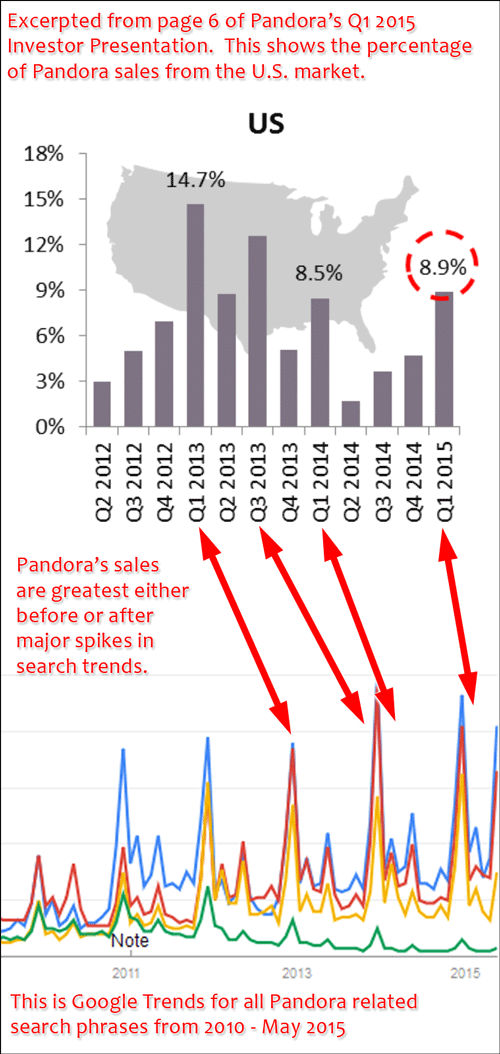

Page 6 of those slides has some interesting sales percentages for the U.S. market that I've pulled out below:

This image shows the cross reference of Pandora's sales to the search trends. The highest sales spike for Pandora took place in Q1 2013. That's a direct result of the 2012 holiday season sales and Pandora's requirement for their retailers to reorder the inventory they sold.

Even though 2010 and 2011 holiday seasons had similar height spikes in search trends, it wasn't the holiday 2012 season that Pandora jewelry really caught on, creating that 14.7% sales spike you see in Q1 2013. Again, a requirement for store to reorder.

The Q3 2013 spike in sales appeared because retailers were stocking up on holiday inventory. Likewise, the Q1 2014 spike is from post-holiday reorders.

Finally, it's the Q1 2015 number that was just reported last week. No doubt that 8.9% is a result of the post-holiday 2014 reorders.

Pandora has worked very hard to maintain their corporate identity throughout the entire world. They have very strict marketing rules. Retailers are forced to use all their pre-made ads, ad copy, descriptions, and photography. My own retailers are forced to surrender their customer list so Pandora can send emails and direct mail on their behalf.

From Pandora's point of view, this is their way to completely control their worldwide brand image. Retailers simply are not allowed to create their own marketing material, and those that do, run the risk of having their reseller agreement revoked. This amount of forced control prevents retail jewelers from developing their own ad campaigns which would resonate more with the local audience.

On Wednesday, May 13, 2015, National Jeweler reported that Pandora closed accounts in their bottom two tiers of their retail store business model.

I had heard rumors in March and April 2015 that Pandora was sending out divorce letters to many retailers creating fear in others because so many have come to rely on the Pandora product to generate foot traffic.

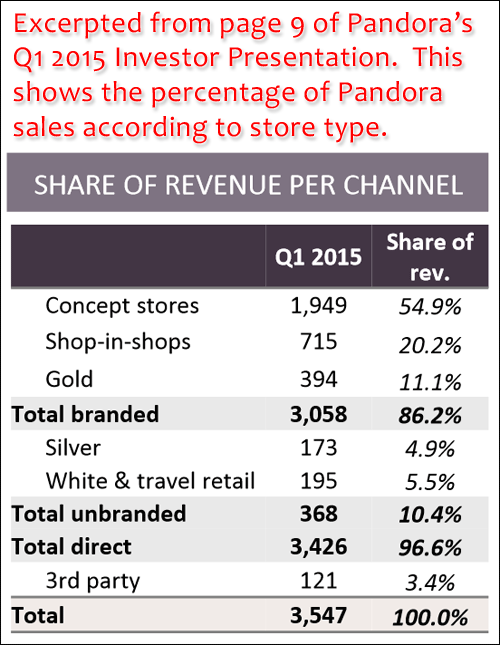

Here's another excerpt from the inventor teleconference:

The above table shows the sales percentages for the "Silver" and "White" level retailer accounts. With only 10.4% of Pandora's total sales, it's no wonder that National Jeweler reported their closing.

Remember that as a public company, Pandora is required to generate profits for their investors. I was a stock broker a long time ago, and when I look at these numbers, I see an easy way for Pandora to improve their numbers. Simply divert the resources used to support the 10.4% of sales into better supporting the Concept stores.

The way I see it, even the Gold level retailers are at risk of getting divorce letters as Pandora further promotes their e-commerce business and their full Concept stores.

Because Pandora controls their branding so tightly, it seems obvious to me that in the near future they would only want to support a select number of high performing retailer Shop-in-shops and completely do away with any store where they cannot control the customer buying experience.

Future for Retailers

So what is a retailer to do if they rely on the foot traffic generated by Pandora ads?

If you want to sunset Pandora, then you need to develop a marketing campaign that doesn't promote their line at all, which should be easy because you shouldn't be doing that anyway. Let Pandora continue to run the necessary ads for those free bracelet events or other seasonal specials, but don't promote it yourself.

When was the last time you really examined your merchandising? If Pandora is pulling in a lot of foot traffic, then you will need to find something to equally attract customers. You might be able to do this with creative marketing campaigns for what you already carry, or you can try something new.

If you carry Pandora and are worried about your future, then I suggest you take a look at this Nugget which gives ideas for finding new designer lines for your store.

I also suggest that you pay attention to the Style Pages in The Retail Jeweler Magazine and the gallery pages on National Jeweler.

As a retail jeweler, you should never fear the contract terms forced upon you by large designers. Don't let them treat you like just another account. According to the data I dug up last month, there are only 16,847 independent retail jewelers in the U.S. Those independent retailers build their reputations on personalized service and getting to know their customers, which seems to be completely opposite from the strict corporate approach that Pandora is forcing.

Conclusion

Don't like the way Pandora is treating you? It's only a matter of time before they send you your walking papers. Make sure to use that time wisely and start planting the seeds of alternative marketing and products.